Inherited roth ira rmd calculator

You can also explore your IRA beneficiary withdrawal options based. Discover Which Retirement Options Align with Your Financial Needs.

Your Search For The New Life Expectancy Tables Is Over Ascensus

RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value.

. Talk to a Financial Advisor Today. Talk to a Financial Advisor Today. Ad Use This Calculator to Determine Your Required Minimum Distribution.

If this situation occurs this calculator will use the account owners age when calculating RMDs. It Is Easy To Get Started. Ad Develop Your Retirement Savings Strategy.

The SECURE act changed the RMDs for inherited IRAs. It is mainly intended for use by US. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

Account balance as of December 31 2021 7000000 Life expectancy factor. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. These rules apply to BOTH traditional IRAs and Roth IRAs.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Check the status of your inherited account Log in to your account Register for web access Were here to help. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age.

If youre inheriting a Roth IRA your RMD would be calculated as outlined above. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Allows talk about the.

If you are age 72 you may be subject to taking. While the original account owner was not required to take RMDs from their Roth IRAs if you inherit a Roth IRA and transfer the. Ad Develop Your Retirement Savings Strategy.

RMD amounts are based on your age and are recalculated each year based on factors in the IRS. Other than using the account owners age at death the calculation is identical to the one stated. Under the 10-year rule the value of the inherited IRA needs to be zero by Dec.

Read customer reviews find best sellers. If you move your money into an inherited IRA you withdraw RMDs based on your age. Build Your Future With a Firm that has 85 Years of Retirement Experience.

31 on the 10th anniversary of the owners. If you want to simply take your inherited money right now and pay taxes you can. Distribute using Table I.

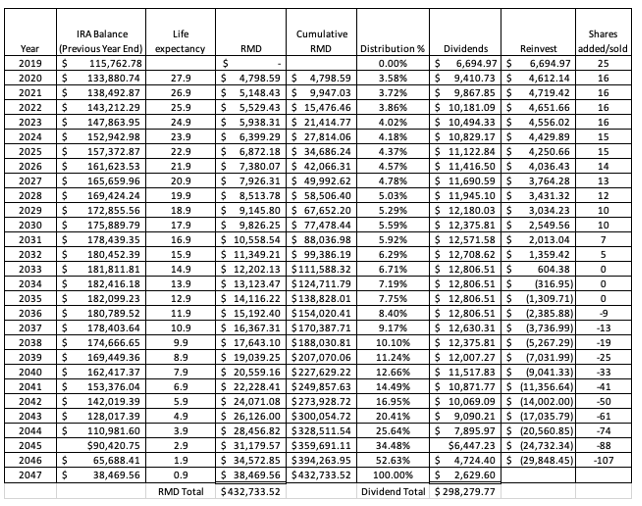

Traditional or Rollover Your 401k Today. In each case the RMD is calculated by dividing the year-end account value by the applicable life expectancy factor. You can set up an inherited Roth IRA and take distributions throughout your lifetime.

RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. You must begin taking RMDs from a traditional IRA by April 1 of the year after you turn 72 the old threshold of 70½ still applies if you hit that age by Jan. Discover Which Retirement Options Align with Your Financial Needs.

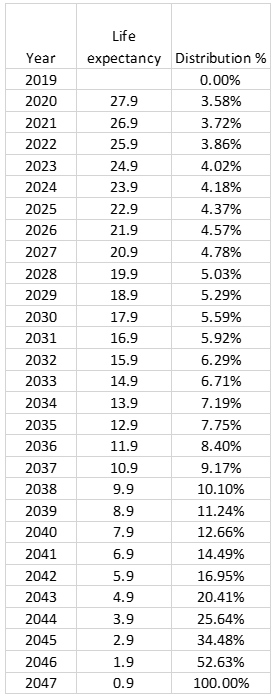

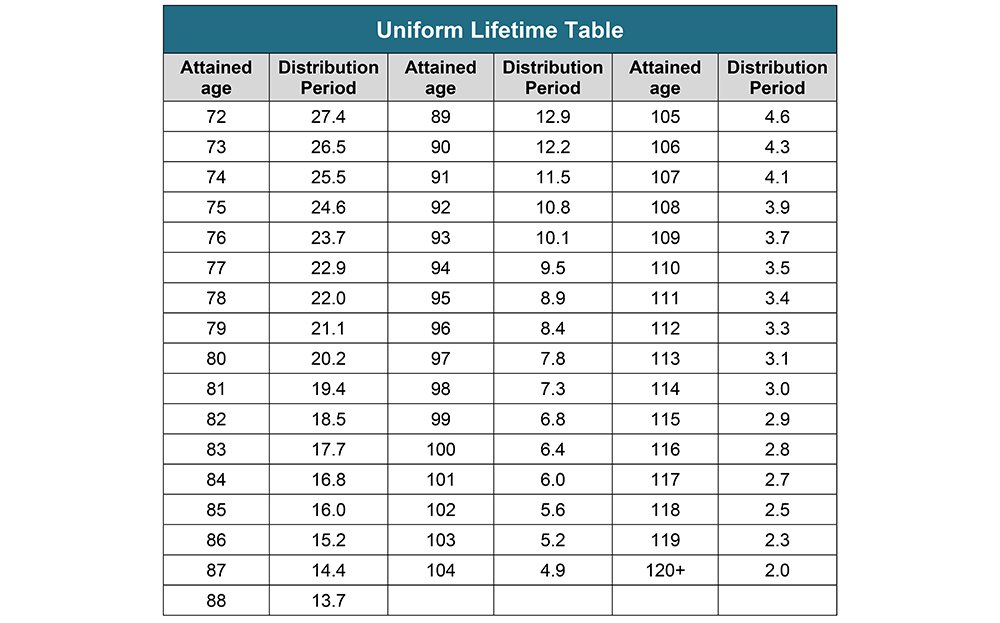

You will need to divide your IRA account balance by your life expectancy or distribution period to obtain your RMD. Required Minimum Distribution Calculator At age 72 federal law requires. 0 Your life expectancy factor is taken from the IRS.

Inherited Roth IRA Rmd Calculator. Thinking youre not around to retire next year you want development as well as concentrated investments for your Roth IRA. Browse discover thousands of brands.

But if you want to defer taxes as long as possible there are certain distribution requirements with which you. RMDs are determined by your age and life expectancy calculated according to the IRS. How is my RMD calculated.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Traditional RMD Calculator This calculator is undergoing maintenance for the new IRS tables. Determine beneficiarys age at year-end following year of owners.

Ad Understand Your Options - See When And How To Rollover Your 401k. For assistance please contact 800-435-4000. Schwab Has 247 Professional Guidance.

Ad Open an IRA Explore Roth vs. The account balance youll use to figure this out should. If inherited assets have been transferred.

If inherited assets have been transferred into an inherited IRA in your name.

What Is A Required Minimum Distribution Taylor Hoffman

The Inherited Ira Portfolio Seeking Alpha

Rmd Calculator Required Minimum Distributions Calculator

The Inherited Ira Portfolio Seeking Alpha

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Required Minimum Distributions For Retirement Morgan Stanley

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Avoid This Rmd Tax Trap Kiplinger

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Required Minimum Ira Distributions Tax Pro Plus

Rmd Table Rules Requirements By Account Type

Rmds Tis The Season For Required Minimum Distributions

Where Are Those New Rmd Tables For 2022

Required Minimum Ira Distributions Tax Pro Plus

Your Search For The New Life Expectancy Tables Is Over Ascensus

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More